What Will Drive China to War?

A cold war is already under way. The question is whether Washington can deter Beijing from initiating a hot one.

By

Michael Beckley and

Hal Brands

Ben Hickey

November 1, 2021

About the authors:

Michael Beckley is a Jeane Kirkpatrick Visiting Fellow at the American Enterprise Institute, where his research focuses on U.S.-China competition, and is an associate professor at Tufts University.

Hal Brands is a senior fellow at the American Enterprise Institute, where he studies US foreign policy and defense strategy, and is the Henry A. Kissinger Distinguished Professor of Global Affairs at the Johns Hopkins School of Advanced International Studies.

President Xi Jinping declared

in July that those who get in the way of China’s ascent will have their “heads bashed bloody against a Great Wall of steel.” The People’s Liberation Army Navy is churning out ships at a rate not seen since World War II, as Beijing issues threats against Taiwan and other neighbors. Top Pentagon officials have warned that China could start a military conflict in the Taiwan Strait or other geopolitical hot spots sometime this decade.

Analysts and officials in Washington are fretting over worsening tensions between the United States and China and the risks to the world of two superpowers once again clashing rather than cooperating. President Joe Biden

has said that America “is not seeking a new cold war.” But that is the wrong way to look at U.S.-China relations. A cold war with Beijing is already under way. The right question, instead, is whether America can deter China from initiating a hot one.

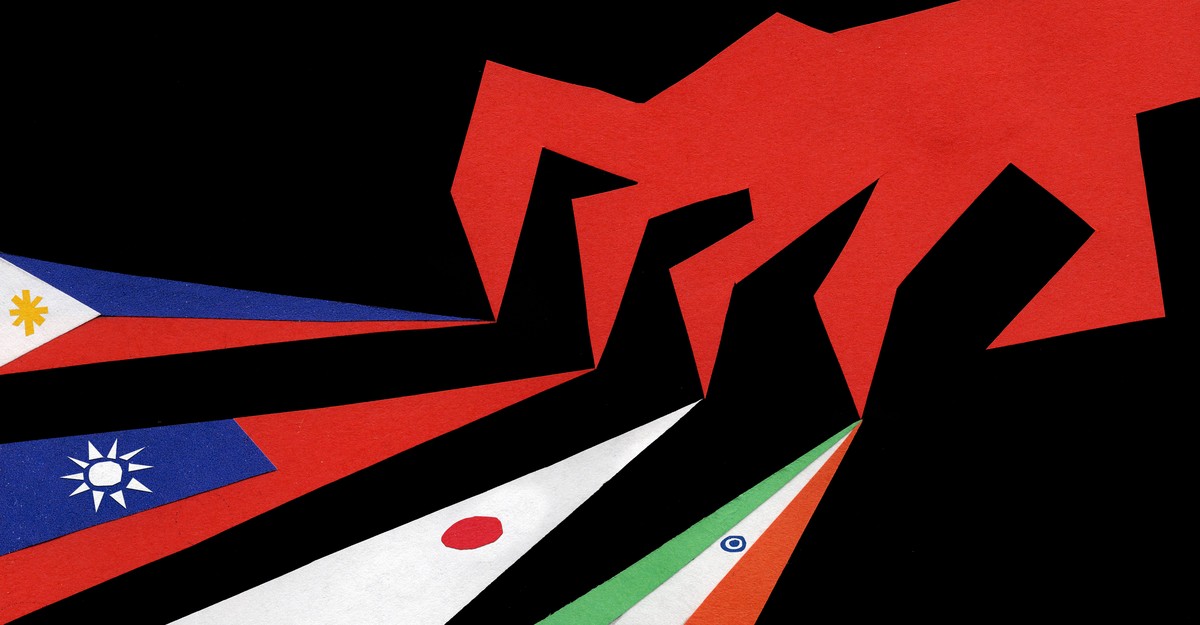

Beijing is a remarkably ambitious revanchist power, one determined to make China whole again by “reuniting” Taiwan with the mainland, turning the East and South China Seas into Chinese lakes, and grabbing regional primacy as a stepping-stone to global power. It is also increasingly encircled, and faces growing resistance on many fronts—just the sort of scenario that has led it to lash out in the past.

The historical record since the founding of the People’s Republic of China in 1949 is clear: When confronted by a mounting threat to its geopolitical interests, Beijing does not wait to be attacked; it shoots first to gain the advantage of surprise.

In conflicts including the Korean War and clashes with Vietnam in 1979, China has often viewed the use of force as an educational exercise. It is willing to pick even a very costly fight with a single enemy to teach it, and others observing from the sidelines, a lesson.

Today, Beijing might be tempted to engage in this sort of aggression in multiple areas. And once the shooting starts, the pressures for escalation are likely to be severe.

Numerous

scholars have analyzed when and why Beijing uses force. Most reach a similar conclusion: China attacks not when it feels confident about the future but when it worries its enemies are closing in. As

Thomas Christensen, the director of the China and the World Program at Columbia University, writes, the Chinese Communist Party wages war when it perceives an opening window of vulnerability regarding its territory and immediate periphery, or a closing window of opportunity to consolidate control over disputed areas. This pattern holds regardless of the strength of China’s opponent. In fact, Beijing often has attacked far superior foes—including the U.S.—to cut them down to size and beat them back from Chinese-claimed or otherwise sensitive territory.

Examples of this are plentiful. In 1950, for instance, the fledgling PRC was less than a year old and destitute, after decades of civil war and Japanese brutality. Yet it nonetheless mauled advancing U.S. forces in Korea out of concern that the Americans would conquer North Korea and eventually use it as a base to attack China. In the expanded Korean War that resulted, China suffered almost 1 million casualties, risked nuclear retaliation, and was slammed with punishing economic sanctions that stayed in place for a generation. But to this day, Beijing celebrates the intervention as a glorious victory that warded off an existential threat to its homeland.

In 1962, the PLA attacked Indian forces, ostensibly because they had built outposts in Chinese-claimed territory in the Himalayas. The deeper cause was that the CCP feared that it was being surrounded by the Indians, Americans, Soviets, and Chinese Nationalists, all of whom had increased their military presence near China in prior years. Later that decade, fearing that China was next on Moscow’s hit list as part of efforts to defeat “counterrevolution,” the Chinese military ambushed Soviet forces along the Ussuri River and set off a seven-month undeclared conflict that once again risked nuclear war.

In the late ’70s, Beijing picked a fight with Vietnam. The purpose, remarked Deng Xiaoping, then the leader of the CCP, was to “teach Vietnam a lesson” after it started hosting Soviet forces on its territory and invaded Cambodia, one of China’s only allies. Deng feared that China was being surrounded and that its position would just get worse with time. And from the ’50s to the ’90s, China nearly started wars on three separate occasions by firing artillery or missiles at or near Taiwanese territory, in 1954–55, 1958, and 1995–96. In each case, the goal was—among other things—to deter Taiwan from forging a closer relationship with the U.S. or declaring its independence from China.

To be clear, every decision for war is complex, and factors including domestic politics and the personality quirks of individual leaders have also figured in China’s choices to fight. Yet the overarching pattern of behavior is consistent: Beijing turns violent when confronted with the prospect of permanently losing control of territory. It tends to attack one enemy to scare off others. And it rarely gives advance warning or waits to absorb the initial blow.

For the past few decades, this pattern of first strikes and surprise attacks has seemingly been on hold. Beijing’s military hasn’t fought a major war since 1979. It hasn’t shot at large numbers of foreigners since 1988, when Chinese frigates gunned down 64 Vietnamese sailors in a clash over the Spratly Islands. China’s leaders often claim that their country is a uniquely peaceful great power, and at first glance, the evidence backs them up.

But the China of the past few decades was a historical aberration, able to amass influence and wrest concessions from rivals merely by flaunting its booming economy. With 1.3 billion people, sky-high growth rates, and an authoritarian government that courted big business, China was simply too good to pass up as a consumer market and a low-wage production platform. So country after country curried favor with Beijing.

Britain handed back Hong Kong in 1997. Portugal gave up Macau in 1999. America fast-tracked China into major international institutions, such as the World Trade Organization. Half a dozen countries settled territorial disputes with China from 1991 to 2019, and more than 20 others cut diplomatic ties with Taiwan to secure relations with Beijing. China was advancing its interests without firing a shot and, as Deng remarked, “hiding its capabilities and biding its time.”

Those days are over. China’s economy, the engine of the CCP’s international clout, is starting to sputter. From 2007 to 2019,

growth rates fell by more than half,

productivity declined by more than 10 percent, and overall

debt surged eightfold. The coronavirus pandemic has dragged down growth even further and plunged Beijing’s finances deeper into the red. On top of all this, China’s

population is aging at a devastating pace: From 2020 to 2035 alone, it will lose 70 million working-age adults and gain 130 million senior citizens.

Countries have recently become less enthralled by China’s market and more worried about its coercive capabilities and aggressive actions. Fearful that Xi might attempt forced reunification, Taiwan is tightening its ties to the U.S. and revamping its defenses. For roughly a decade, Japan has been engaged in its largest military buildup since the Cold War; the ruling Liberal Democratic Party is now

talking about doubling defense spending. India is massing forces near China’s borders and vital sea lanes. Vietnam and Indonesia are expanding their air, naval, and coast-guard forces. Australia is opening up its northern coast to U.S. forces and acquiring long-range missiles and nuclear-powered attack submarines. France, Germany, and the United Kingdom are sending warships into the Indo-Pacific region. Dozens of countries are looking to cut China out of their supply chains; anti-China coalitions, such as the Quad and AUKUS, are proliferating.

Globally, opinion polls show that fear and mistrust of China has reached a post–Cold War high. All of which raises a troubling question: If Beijing sees that its possibilities for easy expansion are narrowing, might it begin resorting to more violent methods?

China is already moving in that direction. It has been using its maritime militia (essentially a covert navy), coast guard, and other “gray zone” assets to coerce weaker rivals in the Western Pacific. Xi’s government provoked a bloody scrap with India along the disputed Sino-Indian frontier in 2020,

reportedly out of fear that New Delhi was aligning more closely with Washington.

Beijing certainly has the means to go much further. The CCP has spent $3 trillion over the past three decades building a military that is designed to defeat Chinese neighbors while blunting American power. It also has the motive: In addition to slowing growth and creeping encirclement, China faces closing windows of opportunity in its most important territorial disputes.

China’s geopolitical aims are not a secret. Xi, like his predecessors, desires to make China the preponderant power in Asia and, eventually, the world. He wants to consolidate China’s control over important lands and waterways the country lost during the “century of humiliation” (1839–1949), when China was ripped apart by imperialist powers. These areas include Hong Kong, Taiwan, chunks of Indian-claimed territory, and some 80 percent of the East and South China Seas.

The Western Pacific flash points are particularly vital. Taiwan is the site of a rival, democratic Chinese government in the heart of Asia with strong connections to Washington. Most of China’s trade passes through the East and South China Seas. And China’s primary antagonists in the area—Japan, Taiwan, the Philippines—are part of a strategic chain of U.S. allies and partners whose territory blocks Beijing’s access to the Pacific’s deep waters.

The CCP has staked its legitimacy on reabsorbing these areas and has cultivated an intense, revanchist form of nationalism among the Chinese people. Schoolchildren study the century of humiliation. National holidays commemorate foreign theft of Chinese lands. For many citizens, making China whole again is as much an emotional as a strategic imperative. Compromise is out of the question. “We cannot lose even one inch of the territory left behind by our ancestors,” Xi told James Mattis, then the U.S. secretary of defense, in 2018.

Taiwan is the place where China’s time pressures are most severe. Peaceful reunification has become extremely unlikely: In August 2021, a record 68 percent of the Taiwanese public identified solely as Taiwanese and not as Chinese, and more than 95 percent wanted to maintain the island’s de facto sovereignty or declare independence. China retains viable military options because its missiles could incapacitate Taiwan’s air force and U.S. bases on Okinawa in a surprise attack, paving the way for a successful invasion. But Taiwan and the U.S. now recognize the threat.

President Biden

recently stated that America would fight to defend Taiwan from an unprovoked Chinese attack. Washington is planning to harden, disperse, and expand its forces in the Asia-Pacific by the early 2030s. Taiwan is pursuing, on a similar timeline, a defense strategy that would use cheap, plentiful capabilities such as anti-ship missiles and mobile air defenses to make the island an incredibly hard nut to crack. This means that China will have its best chance from now to the end of the decade. Indeed, the military balance will temporarily shift further in Beijing’s favor in the late 2020s, when many aging U.S. ships, submarines, and planes will have to be retired.

This is when America will be in danger, as the former Pentagon official David Ochmanek

has remarked, of getting “its ass handed to it” in a high-intensity conflict. If China does attack, Washington could face a choice between escalation or seeing Taiwan conquered.

More such dilemmas are emerging in the East China Sea. China has spent years building an armada, and the balance of naval tonnage currently favors Beijing. It regularly sends well-armed coast-guard vessels into the waters surrounding the disputed Senkaku Islands to weaken Japan’s control there. But Tokyo has plans to regain the strategic advantage by turning amphibious ships into aircraft carriers for stealth fighters armed with long-range anti-ship missiles. It is also using geography to its advantage by stringing missile launchers and submarines along the Ryukyu Islands, which stretch the length of the East China Sea.

Meanwhile, the U.S.-Japan alliance, once a barrier to Japanese remilitarization, is becoming a force multiplier. Tokyo has reinterpreted its constitution to fight more actively alongside the U.S. Japanese forces regularly operate with American naval vessels and aircraft; American F-35 fighters fly off of Japanese ships; U.S. and Japanese officials now confer routinely on how they would respond to Chinese aggression—and publicly advertise that cooperation.

For years, Chinese strategists have speculated about a short, sharp war that would humiliate Japan, rupture its alliance with Washington, and serve as an object lesson for other countries in the region. Beijing could, for instance, land or parachute special forces on the Senkakus, proclaim a large maritime exclusion zone in the area, and back up that declaration by deploying ships, submarines, warplanes, and drones—all supported by hundreds of conventionally armed ballistic missiles aimed at Japanese forces and even targets in Japan. Tokyo then would either have to accept China’s fait accompli or launch a difficult and bloody military operation to recapture the islands. America, too, would have to choose between retreat and honoring the pledges it made—in 2014 and in 2021—to help Japan defend the Senkakus. Retreat might destroy the credibility of the U.S.-Japan alliance. Resistance,

war games held by prominent think tanks suggest, could easily lead to rapid escalation resulting in a major regional war.

What about the South China Sea? Here, China has grown accustomed to shoving around weak neighbors. Yet opposition is growing. Vietnam is stocking up on mobile missiles, submarines, fighter jets, and naval vessels that can make operations within 200 miles of its coast very difficult for Chinese forces. Indonesia is ramping up defense spending—a 20 percent hike in 2020 and another 16 percent in 2021—to buy dozens of fighters, surface ships, and submarines armed with lethal anti-ship missiles. Even the Philippines, which courted Beijing for most of President Rodrigo Duterte’s term, has been increasing air and naval patrols, conducting military exercises with the U.S., and planning to purchase cruise missiles from India. At the same time, a formidable coalition of external powers—the U.S., Japan, India, Australia, Britain, France, and Germany—are conducting freedom-of-navigation exercises to contest China’s claims.

From Beijing’s perspective, circumstances are looking ripe for a teachable moment. The best target might be the Philippines. In 2016, Manila challenged China’s claims to the South China Sea before the Permanent Court of Arbitration and won. Beijing might relish the opportunity to reassert its claims—and warn other Southeast Asian countries about the cost of angering China—by ejecting Filipino forces from their isolated, indefensible South China Sea outposts. Here again, Washington would have few good options: It could stand down, effectively allowing China to impose its will on the South China Sea and the countries around it, or it could risk a much bigger war to defend its ally.

Get ready for the “

terrible 2020s”: a period in which China has strong incentives to grab “lost” land and break up coalitions seeking to check its advance. Beijing possesses grandiose territorial aims as well as a strategic culture that emphasizes hitting first and hitting hard when it perceives gathering dangers. It has a host of wasting assets in the form of military advantages that may not endure beyond this decade. Such dynamics have driven China to war in the past and could do so again today.

If conflict does break out, U.S. officials should not be sanguine about how it would end. Tamping or reversing Chinese aggression in the Western Pacific could require a massive use of force. An authoritarian CCP, always mindful of its precarious domestic legitimacy, would not want to concede defeat even if it failed to achieve its initial objectives. And historically, modern wars between great powers have more typically gone

long than stayed short. All of this implies that a U.S.-China war could be incredibly dangerous, offering few plausible off-ramps and severe pressures for escalation.

The U.S. and its friends can take steps to deter the PRC, such as drastically speeding the acquisition of weaponry and prepositioning military assets in the Taiwan Strait and East and South China Seas, among other efforts, to showcase its hard power and ensure that China can’t easily knock out U.S. combat power in a surprise attack. At the same time, calmly firming up multilateral plans, involving Japan, Australia, and potentially India and Britain, for responding to Chinese aggression could make Beijing realize how costly such aggression might be. If Beijing understands that it cannot easily or cheaply win a conflict, it may be more cautious about starting one.

Most of these steps are not technologically difficult: They exploit capabilities that are available today. Yet they require an intellectual shift—a realization that the United States and its allies need to rapidly shut China’s windows of military opportunity, which means preparing for a war that could well

start in 2025 rather than in 2035. And that, in turn, requires a degree of political will and urgency that has so far been lacking.

China’s historical warning signs are already flashing red. Indeed, taking the long view of why and under which circumstances China fights is the key to understanding just how short time has become for America and the other countries in Beijing’s path.