Power of Siberia: China keeps Putin waiting on gas pipeline

Beijing is driving a hard bargain as Moscow presses for a new Sino-Russian pipeline through Mongolia

While visiting the Kremlin in March, Xi Jinping, left, skirted around the Power of Siberia 2 project while Vladimir Putin spoke about the plan as if it were a done deal © FT montage/AFP/Getty Images

Anastasia Stognei in Riga, Joe Leahy in Beijing and Yuan Yang in London

MAY 25 2023

Russia’s prime minister left China this week without a reward Moscow has long prized: a clear commitment from Beijing on Power of Siberia 2, a grand gas pipeline project to transform energy flows across Asia.

Conceived more than a decade ago to help Russia “turn to the east”, the pipeline through Mongolia to China was a way to diversify gas sales, bolster revenues, and give the Kremlin more diplomatic clout.

That project, first dubbed “Altai” after the mountainous region of southern Siberia, has taken on new urgency since the invasion of Ukraine, with Moscow seeking new outlets for gas that flowed to Europe before sanctions stood in the way.

The hitch for Moscow is that Beijing — a crucial economic partner since the full-scale invasion of Ukraine — appears in no rush to engage. It is a reticence that analysts say shows how weak wartime Moscow’s bargaining power has become when dealing with its economically more powerful neighbour.

Another Russian pipeline, the Power of Siberia, was launched in 2019 and is expected to reach its maximum capacity of 38 bcm per year by 2024. But this pipeline relied on developing new gasfields in eastern Siberia, which had never sent the fuel to Europe — making it less useful to Moscow’s diversification strategy.

The PS-2, in contrast, aims to supply China with gas from the north-eastern Yamal peninsula, which historically served the European market through several pipelines, including the Nord Stream, whose supplies had ceased to flow in disputes with the EU even before it was sabotaged in 2022.

Seeking alternatives has moved from being a strategic choice on Russia’s part to its only option.

“Beijing has a history of prolonging negotiations to get a better deal — this was the case when the Power of Siberia 1 was negotiated,” said Alicja Bachulska, a China policy expert at the European Council on Foreign Relations. “As Russia’s aggression against Ukraine has turned into a protracted war, Beijing believes that its bargaining position vis-à-vis Moscow can only get stronger.”

Taking its time may enable China to secure a lower price for gas through the pipeline, she added.

Sino-Russian talks over the pipeline had intensified in the months before the war. During the Beijing Olympics, Vladimir Putin and Xi Jinping signed a 25-year contract for the far-eastern route and “definitely talked about the PS-2”, said Tatiana Mitrova, a research fellow at Columbia University’s Center on Global Energy Policy.

But since then, while Russia has repeatedly emphasised its readiness to launch PS-2, Beijing has been conspicuously silent. While visiting the Kremlin in March, Xi skirted around PS-2 — while Putin spoke about the plan as if it were a done deal, saying “practically all parameters . . . have been finalised”.

Mikhail Mishustin, prime minister of Russia, left, and Xi Jinping during a meeting at the Great Hall of the People in Beijing on Wednesday © Sputnik/AlexanderAstafyev/Pool/Reuters

Careful not to depend too heavily on any one supplier, China has been active in securing natural gas contracts for larger quantities than it actually needs, said Gergely Molnar, the International Energy Agency gas analyst.

China relies on Russia for just over 5 per cent of its gas supply, he said. Together with planned increases in supply through existing routes from Russia, agreement on PS-2 would increase that share to about 20 per cent by the early 2030s.

China does stand to gain from the pipeline. It is keen to diversify the country’s energy sources, especially overland supplies from Russia and Central Asia that would be more secure than sea routes in the event of geopolitical or military tensions with the west.

“The transportation of gas is safer to go through Russia, through land transport, compared with [the] faraway Middle East,” said Lin Boqiang, the head of the China Institute for Studies in Energy Policy, Xiamen University.

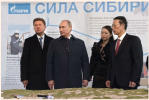

From left, Gazprom chief executive Alexei Miller, Russian president Vladimir Putin and Chinese vice-premiere Zhang Gaoli attend the ceremony marking the welding of the first link of the Power of Siberia in 2014 © Alexey Nikolsky/RIA NOVOSTI/AFP/Getty Images

There are geopolitical complications to agreeing the deal against the backdrop of war in Ukraine. But some China policy experts believe a deeper energy partnership with Russia is only a matter of time.

“No one should really expect that China should cut off its access to Russian oil and gas,” said Victor Gao, vice-president of the Beijing-based Center for China and Globalization. “This kind of trade is normal, it’s peaceful trade.”

He said the huge energy trade between Russia and China would “eventually lead to a reconfiguration of the oil and gas supply in the world . . . and the west should not be surprised by that”.

For Russia, the construction of the PS-2 is the only way to compensate for at least part of the EU market it has lost. That market accounted for most of the gas produced from the Yamal peninsula. But this means there is no particular incentive for China to agree to the new pipeline now.

China, indeed, has been busy developing other overland supplies. At a summit with Central Asian countries last week, Xi championed the construction of the so-called Line D pipeline, which would be China’s fourth in the region bringing gas from Turkmenistan.

About 35 bcm of gas were exported to China via three pipelines from Turkmenistan last year. That compares with 16 bcm sent by Russia via Power of Siberia.

Even with the PS-2 pipeline in place, Russia would not be able to match what it has lost in European sales. The price of this gas would also be lower. Gas sent through the first Power of Siberia pipeline — on terms struck when Russia’s negotiating position was much stronger — is priced well below the European market rate.

Sergei Vakulenko, a former strategy director for Gazprom Neft and a senior fellow at the Carnegie Endowment for International Peace said Russia fails to even match the price China pays for pipeline imports from other suppliers.

Given these factors, PS-2 would generate an estimated $12bn a year for Gazprom, of which the state would receive about $4.6bn in duties and tax, according to Ronald Smith, senior oil and gas analyst at BCS Global Markets.

This sum, equivalent to less than half of Russia’s average monthly energy revenues in 2023, would hardly be transformative. But the Kremlin is desperate for additional revenue as its budget deficit balloons, its war costs increase, and its European gas sales wane.

Mitrova of Columbia University said: “This gas has nowhere else to go.”