Tuo on fakenews. Tehdas näyttää sijaitsevan Oulussa ihan Wikipedian mukaan.Bittiumit:

Suomessa toimii salainen matkapuhelintehdas, jonka sijaintia ei tiedä kukaan - sadat työntekijätkin vaikenevat

Bittium Tough Mobile -puhelimet valmistetaan Suomessa. Mutta missä täällä?www.iltalehti.fi

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

USA:n ja Kiinan välinen globaali kilvoittelu

- Viestiketjun aloittaja Mustaruuti

- Aloitus PVM

Niinpäs onkin.Bittiumit:

Suomessa toimii salainen matkapuhelintehdas, jonka sijaintia ei tiedä kukaan - sadat työntekijätkin vaikenevat

Bittium Tough Mobile -puhelimet valmistetaan Suomessa. Mutta missä täällä?www.iltalehti.fi

Amazonissa näytti olevan myynnissä vähän vajaalla 1200$.

lukkarinapulainen

Majuri

Kolmannella vuosikymmenellään oleva Nokia 6150 eli kyllä. No, on mulla arkistossa tuota kymmenen vuotta nuorempi E63:nenkin ja sekin on 'made in Finland'.Vai onko sinulla joku (huomattavan) vanha Nokian puhelin?

Symbian S60 ja S60v2 alustalla toimivat nokialaiset olivat viimeisiä (ja melkein ensimmäisiä) hyviä älypuhelimia. Ihan puhtaassa matkapuhelinkäytössä Series 20 -käyttöliittymää ei pese mikään ja siihen päälle Frank Nuovon muotoilun aallonharja (sanotaanko 3310 tai 6210/6310), niin maailma on tai oli valmis.

https://arstechnica.com/information...e-processor-wants-to-build-a-plant-in-the-us/This week, two rare-earth mineral-processing companies announced a new joint-venture whose aim will be to establish a rare-earth ore processing plant in Hondo, Texas.

Lynas Corp., an Australian rare-earths processor, and Blue Line Corp., a chemical company which is already based in Texas, agreed to a partnership to "see that US companies have continued access to rare-earth products by offering a US-based source."

Rare-earths minerals are found in consumer electronics, military equipment, electric vehicles, and wind turbines and solar panels. China sees rare-earths metals as a potential wedge in current trade talks with the United States, because it mines and processes the majority of the rare-earths used around the world.

Though a Lynas/Blue Line processing plant in Texas could mitigate some of the threat associated with China's hold on the rare-earths industry, such a plant would likely take a while to get up and running.

Currently, the only rare-earths mine in the US is in Mountain Pass, Calif. But Trump administration tariffs, designed to protect US miners from competition with cheap Chinese raw materials, have actually been hurting Mountain Pass because its primary ore processing plants are in China. Mountain Pass must ship its ore to China to be processed, opening it up to retaliatory Chinese tariffs. According to the The Wall Street Journal, Mountain Pass currently pays a 10 percent tariff on rare-earth ore shipments to China, and on June 1, that's set to increase to 25 percent.

Lynas is one of the largest rare-earths miners and processors outside of China. However, it has a controversial environmental track record at its processing plant in Malaysia (the country is withholding the plant's license renewal contingent on Lynas removing radioactive processing waste that has accumulated there). In addition, rare-earths processing in general is a fairly toxic and resource-intensive endeavor. This suggests that a key factor in whether the Hondo plant will actually materialize will be whether the two companies can comply with US environmental standards while also keeping the processed minerals more affordable than imported rare-earths.

If the Hondo plant does move forward, the companies expect that it would "become the lone major producer of separated medium and heavy rare-earth products outside of China." The plant would focus on separating dysprosium and terbium, rather than light rare-earth products like neodymium and praseodymium, which are processed at Lynas' Malaysia plant.

Huawein perustaja-miljardööri Ren Zhengfei uhmakkaana Bloombergin haastattelussa.

Eikö tuo mies käsitä, että hänen tuotteensa voidaan myös poissulkea markkinoilta kieltämällä? Ei siinä omien chippien värkkäily paljon auta, jos ei saa myydä.

Huawein kapuloita boikotoidaan nyt jo kuluttajien toimesta. En minäkään Huaweita enää ostaisi, koska siihen ei saa päivityksiä ja sillä ei pääse Googlen palveluihin käsiksi.

Tyhmimmät tarjoavat ratkaisuksi Androidin forkkausta. Mutta ei Androidin forkkaus Googlen palveluita forkkaa. Fake-android puhelin ilman Googlen palveluita on ainakin minulle verkonpainoon verrattava hyödyke.

Eikö tuo mies käsitä, että hänen tuotteensa voidaan myös poissulkea markkinoilta kieltämällä? Ei siinä omien chippien värkkäily paljon auta, jos ei saa myydä.

Huawein kapuloita boikotoidaan nyt jo kuluttajien toimesta. En minäkään Huaweita enää ostaisi, koska siihen ei saa päivityksiä ja sillä ei pääse Googlen palveluihin käsiksi.

Tyhmimmät tarjoavat ratkaisuksi Androidin forkkausta. Mutta ei Androidin forkkaus Googlen palveluita forkkaa. Fake-android puhelin ilman Googlen palveluita on ainakin minulle verkonpainoon verrattava hyödyke.

Viimeksi muokattu:

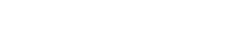

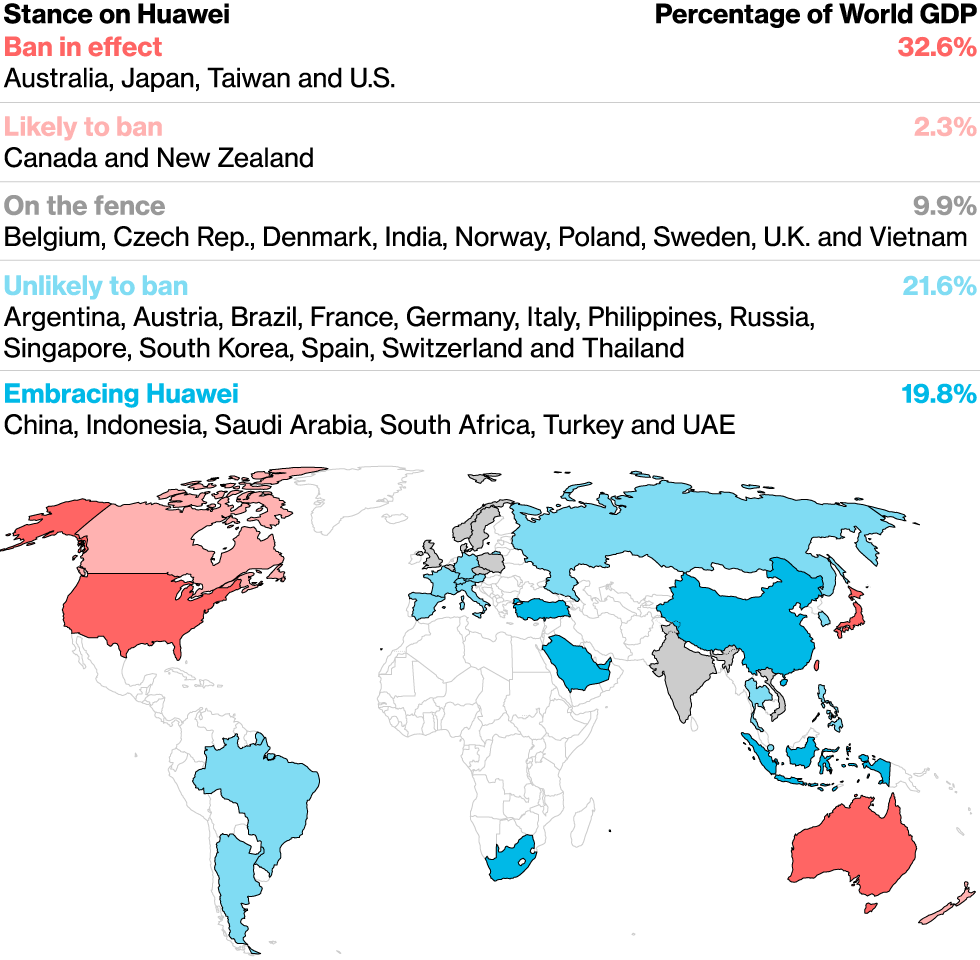

Huaweita vastaan pakotteisiin ryhtyneiden kansantalouksien osuus on nyt liki kolmasosa maailman bruttokansantuotteesta.

Todennäköisesti tuohon tulee vielä noin 10 pinnaa lisää eli yli 40% maailman BKT:stä boikotoisia Huaweita. Teknologiasaralla kuristusote tietysti vielä kamalampi ja kun huomioidaan palvelut, niin Huaweille ei Kiinan ulkopuolella paljon markkinoita ole. Niin suuri on amerikkalaisten internetyhtiöiden valta maailmassa.

Todennäköisesti tuohon tulee vielä noin 10 pinnaa lisää eli yli 40% maailman BKT:stä boikotoisia Huaweita. Teknologiasaralla kuristusote tietysti vielä kamalampi ja kun huomioidaan palvelut, niin Huaweille ei Kiinan ulkopuolella paljon markkinoita ole. Niin suuri on amerikkalaisten internetyhtiöiden valta maailmassa.

Ren Zhengfein uhmakkaan käytöksen arvelin heijastavan Kiinan hallituksen kantoja tähän teknosotaan.

Tämän lähteen mukaan hallituksen mediakanavat rummuttivat koko viime viikon uhmakasta suhtautumista banneihin ja sitä korostettiin, että Huawei pärjää ilmankin.

Artikkelinkirjoittaja on pärjäämisestä vähän toista mieltä. https://www.scmp.com/week-asia/opin...as-wrong-us-can-kill-huawei-heres-why-it-wont

Kiinan hallitus suunnittelee "pitkää marssia" teknologiakehitykseen:

www.scmp.com

www.scmp.com

Tämän lähteen mukaan hallituksen mediakanavat rummuttivat koko viime viikon uhmakasta suhtautumista banneihin ja sitä korostettiin, että Huawei pärjää ilmankin.

Artikkelinkirjoittaja on pärjäämisestä vähän toista mieltä. https://www.scmp.com/week-asia/opin...as-wrong-us-can-kill-huawei-heres-why-it-wont

Kiinan hallitus suunnittelee "pitkää marssia" teknologiakehitykseen:

Chinese officials claim to be untroubled. Faced with US export controls, Beijing is planning to pour vast resources into a “long march” programme to develop its own home-grown designs, semiconductor chips and software.

China’s wrong, the US can kill off Huawei. But here’s why it won’t

China’s claims that Huawei can prosper without the US are given the lie by its past attempts to foster innovation. But it’s in Trump’s interests to reach a deal.

Iranilaisten mukaan USA painostaisi Israelia liittymään mukaan Huawei banniin.

Huawei nakattiin ulos myös SD yhdistyksestä. Tämä tarkoittaa sitä, että jatkossa SD ja SD Micro kortteja on turha kuvitella käyttävänsä tulevissa Huawei malleissa.

www.criticalhit.net

www.criticalhit.net

Huawei barred from using SD cards as fallout from US ban continues

The news is just getting worse for Huawei as more announcements get made on how the proposed US ban on their tech will affect the company.

Ei tuolla mielestäni noin sanota.Huawei nakattiin ulos myös SD yhdistyksestä. Tämä tarkoittaa sitä, että jatkossa SD ja SD Micro kortteja on turha kuvitella käyttävänsä tulevissa Huawei malleissa.

Huawei barred from using SD cards as fallout from US ban continues

The news is just getting worse for Huawei as more announcements get made on how the proposed US ban on their tech will affect the company.www.criticalhit.net

"member of the SD Association (the trade group that agrees upon standardized specs for SD and microSD cards).

NOTE: Membership with the SD Card Association does not confer rights to use the SD logos, essential patents or other technology. These rights are only granted through appropriate license agreements"

Tuo on joku yhdistys joka standardisoi tai muuta vastaavaa.

Muut sopimukset määrittelevät käyttöä. Lisenssit,patentit ja muut sellaiset.

Ei tuolla mielestäni noin sanota.

No otsikossa ainakin sanottiin: "Huawei barred from using SD cards as fallout from US ban continues"

Vai eikö sanottu?

Siellä on myös linkki alkuperäislähteesen, jossa se sanotaan vielä selväsanaisemmin: "Huawei can no longer use microSD cards in smartphones, removed from SD Association"

[Update: It's back] Huawei can no longer use microSD cards in smartphones, removed from SD Association

The latest casuality in the US ban on Huawei has been for microSD cards, as the Chinese company has been de-listed from the SD Association.

Tästä voisi varmaan jo tehdä oman ketjunsa? Huawei vastaan muu maailma. Toki Kiinaanhan tämä elementäärisesti kyllä liittyy, mutta kamaa tulee varmasti ja paljon tähän Huawein johdosta.

Nyt Huawei valittaa, että edes paketit ei heillä kulje kuten pitää. Amerikkalainen FedEx vei dokumenttejä sisältävät paketit Amerikkaan (nuuskittavaksi?)

www.reuters.com

www.reuters.com

Huawei kuvittelee selvivänsä tästä Android-korvikkeella, nimeltään "HongMeng".

www.techradar.com

www.techradar.com

Mahtaakohan kuluttajille HongMeng kelvata? Minulle ainakaan ei tule kelpaamaan, kerron jo etukäteen.

Olemassaolevat Huawei-Android puhelimet muuttuvat pikkuhiljaa elektroniikkaromuksi. Pohdintaa asiasta. Myydäkö vai pitää?

www.androidcentral.com

www.androidcentral.com

Rohkeimmat pohtivat vielä ostamistakin. Asialla peräti finanssilehti Forbes. Itse en kyllä ostamaan rupea näillä hinnoilla. Huawein myynti tulee sakkaamaan ja niiden on pakko alentaa hintoja roimasti jotta kuluttajille kelpaisi (jos kelpaa sittenkään). Odottelen hintarommausta ja harkitsen sitten, ostanko. Jonkun Huawei P30 Pron voin ostaa sen kameroiden vuoksi. Mutta en maksa nykyisin pyydettyä 900 egee siitä. 300 max.

www.forbes.com

www.forbes.com

Hyvä yhteenveto Huawein taipaleesta Public Enemy #1 of the United States:iksi.

qz.com

qz.com

Nyt Huawei valittaa, että edes paketit ei heillä kulje kuten pitää. Amerikkalainen FedEx vei dokumenttejä sisältävät paketit Amerikkaan (nuuskittavaksi?)

Exclusive: Huawei reviewing FedEx relationship, says packages 'diverted'

Chinese telecoms equipment maker Huawei is reviewing its relationship with FedEx Corp after it claimed the U.S. package delivery company, without detailed explanation, diverted two parcels destined for Huawei addresses in Asia to the United States and attempted to reroute...

Huawei kuvittelee selvivänsä tästä Android-korvikkeella, nimeltään "HongMeng".

Huawei says its Android OS replacement launch date is still undecided [Updated]

Earlier quotes stating June launch confirmed to be false

Mahtaakohan kuluttajille HongMeng kelvata? Minulle ainakaan ei tule kelpaamaan, kerron jo etukäteen.

Olemassaolevat Huawei-Android puhelimet muuttuvat pikkuhiljaa elektroniikkaromuksi. Pohdintaa asiasta. Myydäkö vai pitää?

Best Huawei phones 2022

Huawei is the second-largest smartphone manufacturer in the world, and while it is currently embroiled in a U.S. trade ban, it continues to roll out great phones. These are the best ...

www.androidcentral.com

www.androidcentral.com

Rohkeimmat pohtivat vielä ostamistakin. Asialla peräti finanssilehti Forbes. Itse en kyllä ostamaan rupea näillä hinnoilla. Huawein myynti tulee sakkaamaan ja niiden on pakko alentaa hintoja roimasti jotta kuluttajille kelpaisi (jos kelpaa sittenkään). Odottelen hintarommausta ja harkitsen sitten, ostanko. Jonkun Huawei P30 Pron voin ostaa sen kameroiden vuoksi. Mutta en maksa nykyisin pyydettyä 900 egee siitä. 300 max.

Should You Still Buy A Huawei Phone?

Huawei’s smartphones are among the most popular handsets available today. However, given that Huawei is enthralled in security controversies and Donald Trump’s executive order, should you still consider a Huawei phone?

www.forbes.com

www.forbes.com

Hyvä yhteenveto Huawein taipaleesta Public Enemy #1 of the United States:iksi.

How Huawei became America’s tech enemy No. 1

Since it was founded by former People’s Liberation Army engineer Ren Zhengfei in 1987, Huawei has grown to become the world’s top provider of telecom equipment, with over $100 billion in revenue and 180,000 global employees. That extraordinary success has come with barely a footprint in the US...

Huawein HongMeng käyttöjärjestelmästä päivittyvä Wikipedia artikkeli:

en.wikipedia.org

en.wikipedia.org

Yllättäen käyttis on "suljetun sorsan"käyttis? Eli käyttäjä ei tiedä mitä Huawei siellä taustalla puuhaa....kiva kiva.

Ei liene myöskään välttämättä vähäbugisin softa koska suljettu.

Toinen seikka. Huawei on selvästi valmistautunut tämmöiseen skenaarioon. Ei tämä puskista heille tullut. Käynyt rivien välistä ilmi moneenkin kertaan se seikka, että tämä ei ollut yllätys Huaweille tai edes Kiinan johdolle.

Pidän sitä syyllisyyden osoituksena. Huawei ja Kiinan kansantasavalta tietää siis tehneensä syntiä lännessä - ja on siksi valmistautunut tällaiseen viranomaisreaktioon jo pidempään.

Hongmeng OS - Wikipedia

en.wikipedia.org

en.wikipedia.org

Yllättäen käyttis on "suljetun sorsan"käyttis? Eli käyttäjä ei tiedä mitä Huawei siellä taustalla puuhaa....kiva kiva.

Ei liene myöskään välttämättä vähäbugisin softa koska suljettu.

Toinen seikka. Huawei on selvästi valmistautunut tämmöiseen skenaarioon. Ei tämä puskista heille tullut. Käynyt rivien välistä ilmi moneenkin kertaan se seikka, että tämä ei ollut yllätys Huaweille tai edes Kiinan johdolle.

Pidän sitä syyllisyyden osoituksena. Huawei ja Kiinan kansantasavalta tietää siis tehneensä syntiä lännessä - ja on siksi valmistautunut tällaiseen viranomaisreaktioon jo pidempään.

Kiina uhkaa lopettaa harvinaisten maametallien viennin Yhdysvaltoihin – vaikeuttaisi kokonaisten teollisuudenhaarojen toimintaa

Kiina on aiemminkin käyttänyt harvinaisia maametalleja aseina kauppasodissa.

Sopiikin ehken paremmin tännekkin. Mutta uhkaus lopettaa harvinaisten metallien vienti USA.

StepanRudanskij

Greatest Leader

Kiina uhkaa lopettaa harvinaisten maametallien viennin Yhdysvaltoihin – vaikeuttaisi kokonaisten teollisuudenhaarojen toimintaa

Kiina on aiemminkin käyttänyt harvinaisia maametalleja aseina kauppasodissa.yle.fi

Sopiikin ehken paremmin tännekkin. Mutta uhkaus lopettaa harvinaisten metallien vienti USA.

Noita sitten ostetaan ja kaivetaan muualta. Suomestakin. Kierrätystä tehostetaan jne.

New York Times kuvailee mukavasti Trumpin hallinnon olevan pystyttämässä uutta Rautaesiriippua.

"Valitse puolesi. Oletko Muurin tällä puolella, missä Vapaan maailman demokraatit vaikuttavat vai menetkö kommareiden kanssa Kiinan joukkueseen?"

www.nytimes.com

www.nytimes.com

PS. Trumppi sai Muurinsa. No vähän eri paikkaan kun Mehhikon rajalle mutta muuri kuin muuri.

"Valitse puolesi. Oletko Muurin tällä puolella, missä Vapaan maailman demokraatit vaikuttavat vai menetkö kommareiden kanssa Kiinan joukkueseen?"

Trump Wants to Wall Off Huawei, but the Digital World Bridles at Barriers (Published 2019)

Washington argues that global leaders must choose between an internet of Western values and one based on an authoritarian regime. If they do, how will data be divided? And would a self-reliant China be an even greater threat?

PS. Trumppi sai Muurinsa. No vähän eri paikkaan kun Mehhikon rajalle mutta muuri kuin muuri.

https://www.theregister.co.uk/2019/05/28/fedex_huawei_spat/In addition to mistrusting foreign technology companies because of the risk of IP packet diversion, nation-states may also have to shy away from foreign shipping firms for fear of package diversion.

US-based shipping giant FedEx on Tuesday apologized following a Reuters report that two packages addressed to Huawei in China from a supplier in Japan ended up being rerouted to the US without authorization. The packages found their way to FedEx's headquarters in Memphis, Tennessee.

Huawei provided images of tracking records to support its claims, which also detailed the unsuccessful attempted diversion of two Huawei shipments from Vietnam to other locations in Asia.

"We value all of our customers who entrust more than 15m packages a day with us," a FedEx spokesperson said in a statement emailed to The Register.

"We regret that this isolated number of Huawei packages were inadvertently misrouted, and confirm that they are in the process of being returned to the shippers. This instance is not indicative of the exceptional service our 450,000 team members provide on a daily basis around the world as they work continuously to live up to each of our customer’s expectations."

In other words, according to FedEx, yes, some packages went the wrong way: that happens when you ship 15 million parcels a day.

A spokesperson for Huawei's US division confirmed to El Reg that, indeed, its packages were misrouted, adding: "Huawei is in the process of reviewing our logistics and document deliver support requirements."

The manufacturer's spokesperson said Huawei isn't taking a position on FedEx's claim that the error was inadvertent. Nonetheless, the telecom kit maker has reportedly filed a complaint with China’s State Postal Bureau.

https://warisboring.com/south-korea...s-as-u-s-china-battle-over-huawei-technology/With the US government ramping up pressure on its allies to reject Huawei Technologies equipment for establishing 5G cellular networks, South Korea is struggling to come up with a response amid the escalating conflicts between the world’s two superpowers.

The Trump administration has reportedly urged the Korean government to prevent companies from purchasing Huawei’s equipment. Citing LG Uplus as an example, an unnamed State Department official has demanded a halt to the mobile carrier’s operations in “sensitive areas,” according to local news reports here last week.

While acknowledging US security concerns, the Ministry of Foreign Affairs has reportedly reserved its position as it is difficult for it to interfere with a private company’s business decision. A ministry spokesperson told reporters Thursday last week that it has consulted with the US on the matter, but didn’t reveal specifics of what was discussed.

“The US has stressed the importance of ensuring security of 5G equipment and we are well aware of its position,” the spokesperson told reporters. “Korea and the US have been constantly consulting on the issue.”

The Moon Jae-in administration’s cautious approach appears to reflect a lesson that Korea learned the hard way when it decided to host a US missile defense system despite opposition from its biggest trading partner.

Retail giant Lotte Group and its affiliates in China suffered massive business losses in 2017 — months after the conglomerate sold land to the Korean military to deploy the THAAD anti-missile defense system.

Lotte was not the only company that bore the brunt of China’s ire over the issue. Sales of Hyundai Motor and cosmetics maker Amorepacfic also saw a steep decline in China. The retaliatory measures appeared to have eased when the Chinese government allowed Lotte to resume work on a shopping mall and leisure facilities earlier this month.

“The US message appears to be simple: We don’t want to rush, but you better come up with your own answer to the Huawei issue,” said a government official, requesting anonymity due to sensitivity of the issue. “Given that the THAAD crisis is still etched in our memory, it’s complicated.”

Näinkin, mutta silloin ne välikädet voi myös joutua sanktioiden alle. Eli onko riskin ottajia.Niinhän tuppaa käymään, jos todella jotakin tarvitaan niin se hankitaan. Tai vaikka kierrätetään jonkun muun maan tai toimijan kautta.

Euroopalle tämä olisi hyvä uutinen, koska amerikkalaiset toimijat joutuisi tappelemaan niistä vähistä Kiinan ulkopuolisista toimittajista. Hinta nousisi heille ja saatavuus heikkenisi eli kilpailukyky laskisi verrattuna Eurooppaan. Kiinan mineraaleille olisi taas vähemmän ottajia eli hinta voisi eurooppalsisille jopa laskea.