Kryptovaluutoilla siirtyy ilman ongelmia. Ja nämä ovat nykyään myös yksi tapa jolla ryssän valtio itsekin hoitaa maksujaan.Määräaikaistalletukset vähentyneet Smartin nimeämättömän lähteen mukaan viime kuussa merkittävästi. Jopa lähes 6%. Vaikka korko korkealla. ruplan noidankehä pyörimässä. Hyvä niin. Mihin muuten mahtavat varoja siirtää, kun pörssi sukeltaa, inflaatio jyllää eikä ulkomaillekaan ilmeisesti luvallisin keinoin rahoja saa siirrettyä?

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Lännen taloussota Venäjälle ja sen seuraukset

- Viestiketjun aloittaja Heinrich

- Aloitus PVM

-TripleX-

Respected Leader

Yksi väistämätön seuraus ruplan arvon romahduksesta on, että viimeisetkin Venäjällä työskentelevät ulkomaalaiset nostavat kytkintä mikä tulee edelleen pahentamaan työvoimapulaa sekä nostamaan palkkoja, mikä sitten taas nostaa ilflaatiota. Kierre on aikalailla valmis, tervemenoa.

teknohippi

Ylipäällikkö

Käyty aiemminkin läpi täällä. Käytännössä ruplaa ostaa vain ryssälästä tavaraa osatavat tahot, vientitulot on käännettävä rupliksi. Tämä ruplavirta sitten mahdollistaa ruplien muunnokset valuutaksi kun keskuspankki myy valuuttaa tiukoin rajoituksin pankeille. Homma pelaa niin kauan kuin ruplaan uskotaan. Nyt ei enää uskota joten tuosta niukasta rupla-valuuttavirrasta tappeleekin isompi määrä valuutanostajia.Jos rupla ei ole vapaasti vaihdettava valuutta (keskuspankki määrittää virallisen vaihtokurssin), niin mitä kursseja nuo käyrät esittävät? Ovatko ne kuvaajia suurimpien pankkien välisestä keskikurssista, joka voi siis määräytyä vapaasti kysynnän ja tarjonnan mukaan keskuspankin määräämättä? Siinä tapauksessahan kurssissa on jonkinmoinen arbitraasimahdollisuus. Toisaalta markkinakurssi saattaisi olla hinnoiteltu myös sen vaihtoehdon varalta, ettei Ryssälässä määrätyillä valuuttakursseilla voisikaan pian enää lunastaa dollareita rupliksi ja päinvastoin.

Kukaan muu maailmassa ei osta ruplia kuin ryssän oma keskuspankki. Tilanne kaatuu omaan mahdottomuuteensa kun ruplilla ei saakkaan enää mitään jolloin kaikki haluaa vain taaloja/euroja. Samalla zaarilta häviää se maksuväline jolla pyörittää keskushallintoa, pamputtajia ja örkkivyöryä Ukrainaan.

Joten kurssi on keinotekoinen koska ympäristö on keinotekoinen mutta nyt tämäkin löyhä keinotekoinen yhteys ulkomaailmaan romahtaa. Seuraava steppi on sitten että ruplia ei osteta keneltäkään ja valuutta tulot jää 100% valtion monopoliksi. Nyt se on sitä vain 95% jotta ryssä luulee omistavansa jotain niinä ruplanumeroina pankkitilillä. No pian ei enää edes luule vaan tietää omistavansa zaarin maksukuponkeja jolla saa säännösteltyä ruokaa tai tavaraa kaupoista silloin kun sitä sinne sattuu tulemaan. Kaikki muu häipyy mustaanpörssiin ja siellä kelpaa vain oikea raha kuten taala tai euro.

Ryssähän yleensä parhaansa mukaan salaa heille negatiivisia asioita, joten lienee aiheellista olettaa että asiat ovat tosiasiassa ainakin joitain pykäliä huonommalla tolalla kuin miltä ne ulospäin näyttävät.

Joten, hyvät herrat, lienee aiheellista pienimuotoiseen optimismiin.

Ja katseet kohti Kazakstania, ja Valko-Venäjää joissa pääkääpiö nyt vierailee, mitä siellä sovitaan vai sovitaanko mitään.

Joten, hyvät herrat, lienee aiheellista pienimuotoiseen optimismiin.

Ja katseet kohti Kazakstania, ja Valko-Venäjää joissa pääkääpiö nyt vierailee, mitä siellä sovitaan vai sovitaanko mitään.

Isänmaan puolesta

Majuri

Kohta on appelsiinikin ylellisyys tuote ryssälle!

Kauppiaat ovat peruneet hedelmä- ja vihannestoimituksia Venäjälle esimerkiksi Iranista, Turkista ja Egyptistä. Kauppiaat ovat laittaneet tuontisopimuksia jäihin entistä suuremman valuuttariskin vuoksi, ja ne vaativat ruplassa käytävään kauppaan jatkuvia hinnankorotuksia.

yle.fi

yle.fi

Kauppiaat ovat peruneet hedelmä- ja vihannestoimituksia Venäjälle esimerkiksi Iranista, Turkista ja Egyptistä. Kauppiaat ovat laittaneet tuontisopimuksia jäihin entistä suuremman valuuttariskin vuoksi, ja ne vaativat ruplassa käytävään kauppaan jatkuvia hinnankorotuksia.

Venäjän rupla putoaa taas vauhdilla, mikä on johtanut jopa vihannestoimitusten perumiseen – tutkija listaa neljä syytä

Valuutan heikkeneminen lisää hintojen nousupainetta Venäjällä, jossa vuosi-inflaatio on jo noin yhdeksässä prosentissa. Ohjauskorko on peräti 21 prosentissa.

taantumu

Ylipäällikkö

Venäjän työttömyysaste laski ennätyksellisen alhaalle 2,3%:iin, jo viides ennätys tänä vuonna. Firmat joutuvat maksamaan kovempaa palkkaa saadakseen työntekijöitä kasvattaen inflaatiota.

https://www.kommersant.ru/doc/7329310Unemployment hits historic low at 2.3%

In October, the unemployment rate hit its historic low for the fifth time this year, reaching 2.3% without taking seasonality into account, according to the monthly report of Rosstat on the socio-economic situation in Russia. Last month, the unemployment rate was the highest since 1991.

According to Rosstat data, 1.8 million citizens aged 15 and older were classified as unemployed in October. The average job search duration for women was 5.3 months, and for men, 5.1 months.

The share of unemployed people who had been looking for work for one to three months was 30.4%, down 2.3 percentage points from September. 12.3% of the total number of unemployed people were in a state of chronic unemployment (they had been looking for work for more than a year). In urban areas, the share of such citizens was 10.3%, in rural areas — 15.7%.

To find work, 25% of the unemployed used the employment service, 69.4% looked for work with the help of friends, relatives and acquaintances.

On October 28, President Vladimir Putin said that unemployment in Russia was at a record low of 2.4% for the third month in a row. At the same time, he reported that unemployment among young people under 25 was decreasing and was 9%.

Antares

Respected Leader

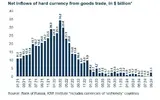

Ukrainalainen analyytikko Elina Ribakova makustelee ryssän talouden numeroita:

Sanctions don’t work… they say.

Sanctioning Gazprom and another 50 or so banks without wavers had an immediate impact.

It also came from fertile soil under macro pressure in Russia.

-

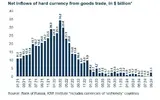

Inflow of “unfriendly” FX has already been diminishing for months to come, putting pressure on the ruble.

-

As a result of the pivot to “friendly” currencies, Russia doesn’t have FX to support the Ruble

-

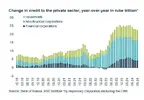

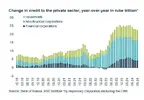

Russia’s runaway credit growth, that not even 21% policy rate can constrain, is also adding to ruble troubles.

-

Money supply growth does affect inaction and the ruble.

I now have only big questions about the 8.5% reported inflation …

-

The Bank of Russia suspend FX purchases until end-2024 due to FX pressure

https://cbr.ru/press/event/?id=23190

News

Share

The Bank of Russia has decided not to purchase foreign currency on the domestic foreign exchange market from November 28, 2024 until the end of 2024 as part of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule. The decision was made in order to reduce the volatility of financial markets.

At the same time, the Bank of Russia will continue, in accordance with the previously announced procedure, to conduct foreign currency sales operations on the domestic currency market related to the replenishment and use of the National Welfare Fund, including taking into account all operations carried out with the fund's funds in 2023, in the amount of 8.40 billion rubles per day.

The decision on the resumption by the Bank of Russia of operations on the domestic foreign exchange market within the framework of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule will be made taking into account the current situation on the financial markets. Deferred purchases will be made during 2025.

Sanctioning Gazprom and another 50 or so banks without wavers had an immediate impact.

It also came from fertile soil under macro pressure in Russia.

-

Inflow of “unfriendly” FX has already been diminishing for months to come, putting pressure on the ruble.

-

As a result of the pivot to “friendly” currencies, Russia doesn’t have FX to support the Ruble

-

Russia’s runaway credit growth, that not even 21% policy rate can constrain, is also adding to ruble troubles.

-

Money supply growth does affect inaction and the ruble.

I now have only big questions about the 8.5% reported inflation …

-

The Bank of Russia suspend FX purchases until end-2024 due to FX pressure

https://cbr.ru/press/event/?id=23190

Bank of Russia Commentary on Foreign Exchange Market Operations under the Budget Rule

November 27, 2024News

Share

The Bank of Russia has decided not to purchase foreign currency on the domestic foreign exchange market from November 28, 2024 until the end of 2024 as part of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule. The decision was made in order to reduce the volatility of financial markets.

At the same time, the Bank of Russia will continue, in accordance with the previously announced procedure, to conduct foreign currency sales operations on the domestic currency market related to the replenishment and use of the National Welfare Fund, including taking into account all operations carried out with the fund's funds in 2023, in the amount of 8.40 billion rubles per day.

The decision on the resumption by the Bank of Russia of operations on the domestic foreign exchange market within the framework of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule will be made taking into account the current situation on the financial markets. Deferred purchases will be made during 2025.

Viimeksi muokattu:

-TripleX-

Respected Leader

No sieltähän se tuli, tämä varmasti vakauttaa luottamusta ruplaan.

Mites vaihto sitten euroihin, jeneihin, yuaniin esimerkiksi, saattaa niissä lähteä huomenna kurssi taas raketoimaan.

Mites vaihto sitten euroihin, jeneihin, yuaniin esimerkiksi, saattaa niissä lähteä huomenna kurssi taas raketoimaan.

Antares

Respected Leader

The Bank of Russia suspend FX purchases until end-2024 due to FX pressure

https://cbr.ru/press/event/?id=23190

News

Share

The Bank of Russia has decided not to purchase foreign currency on the domestic foreign exchange market from November 28, 2024 until the end of 2024 as part of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule. The decision was made in order to reduce the volatility of financial markets.

At the same time, the Bank of Russia will continue, in accordance with the previously announced procedure, to conduct foreign currency sales operations on the domestic currency market related to the replenishment and use of the National Welfare Fund, including taking into account all operations carried out with the fund's funds in 2023, in the amount of 8.40 billion rubles per day.

The decision on the resumption by the Bank of Russia of operations on the domestic foreign exchange market within the framework of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule will be made taking into account the current situation on the financial markets. Deferred purchases will be made during 2025.

-

MUOKKAUS: yksi kommentti tästä:

Russian Central Bank suspends currency purchases:

This is not a very significant move.

Purchases were about $40 million per day (exports: $1.2bn/day)- the effect of suspending it is comparable to an oil price increase of 5 dollars.

CBR did it before in times of ruble weakness.

https://cbr.ru/press/event/?id=23190

Bank of Russia Commentary on Foreign Exchange Market Operations under the Budget Rule

November 27, 2024News

Share

The Bank of Russia has decided not to purchase foreign currency on the domestic foreign exchange market from November 28, 2024 until the end of 2024 as part of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule. The decision was made in order to reduce the volatility of financial markets.

At the same time, the Bank of Russia will continue, in accordance with the previously announced procedure, to conduct foreign currency sales operations on the domestic currency market related to the replenishment and use of the National Welfare Fund, including taking into account all operations carried out with the fund's funds in 2023, in the amount of 8.40 billion rubles per day.

The decision on the resumption by the Bank of Russia of operations on the domestic foreign exchange market within the framework of mirroring the regular operations of the Ministry of Finance of Russia related to the implementation of the budget rule will be made taking into account the current situation on the financial markets. Deferred purchases will be made during 2025.

-

MUOKKAUS: yksi kommentti tästä:

Russian Central Bank suspends currency purchases:

This is not a very significant move.

Purchases were about $40 million per day (exports: $1.2bn/day)- the effect of suspending it is comparable to an oil price increase of 5 dollars.

CBR did it before in times of ruble weakness.

Viimeksi muokattu:

teknohippi

Ylipäällikkö

Pienen tukinnan jälkeen tämänhetken suuren yleisön ruplakurssi on romahtamassa. Käytännössä tämä tarkoittaa sitä että ryssän vienti ja tuonti on epätasapainossa, eli viedään vähemmän kuin tuodaan. Noin jo pitemmän käytännön mukaan ryssälään ei lähde yhtään mitään ellei ensin ole rahat maksettuna. Näin ollen tuossa kaupassa ei ole mitään puskuria, ainoa joustaja on keskupankki ja se jousto tulee valuuttavarannosta. Mitä ilmeisimmin tuo normikulutukseen varattu puskuri on nyt tyhjä. Tilanne tasapainottuu sillä että tuonti vähenee ja mitä ilmeisemmin se vähennys tehdään kulutustavaroissa. Tähän ryssälän pankeille myytävään valuuttaan käytetään vain valtion pakollisista sotatarvikemenoista ylijäävää osaa. No nyt on saavutettu tilanne että ylijäämää ei taida olla -> ryssä ei ulkomaisia habatuksia osta.

Huhuttu 120rupulaa/taala raja tulenee siitä mikämäärä valuutta on varattu kulutustavaraoihin, sitä lienee pienennetty vain sen 50%. Tässä pelissä vain ei taida ryssän matikka pelata kun luotto valuuttaan häipyi joten kaikki ryntää nyt vaihtamaan ruplansa pois. Tilanteen näkee kun katukurssi karkaa pankin kurssista.

Berjoskathan jo palasi ryssälään ja pianhan ollaan tilanteessa että ruplilla saa vain ryssälässä tuotettua tavaraa. Josta siitäkin halutuin osa katoaa ensisijaisesti mustaanpörssiin. Oikealla valuutalla saa sitten mitä vain. Paluu entiseen siis: sekä moskovassa että Washingtonissa saa taaloilla mitä vain ja ruplilla ei mitään.

Jätän raadin pohdintaa mitä tämä tarkoittaa örkin sotimisintoon kun palkka tulee ruplissa mutta niillä ei teekkään mitään. Tätä muutostahan ne temu-sotilaatkin indikoi, niille maksetaan öljyllä, tai siis rakettimies saa öljyä ja käskyttää armeijaansa marssimaan lihamyllyyn.

Noo, kattellaan miten pitkäälle se lilliputinismin aate kantaa rintamalla.

Huhuttu 120rupulaa/taala raja tulenee siitä mikämäärä valuutta on varattu kulutustavaraoihin, sitä lienee pienennetty vain sen 50%. Tässä pelissä vain ei taida ryssän matikka pelata kun luotto valuuttaan häipyi joten kaikki ryntää nyt vaihtamaan ruplansa pois. Tilanteen näkee kun katukurssi karkaa pankin kurssista.

Berjoskathan jo palasi ryssälään ja pianhan ollaan tilanteessa että ruplilla saa vain ryssälässä tuotettua tavaraa. Josta siitäkin halutuin osa katoaa ensisijaisesti mustaanpörssiin. Oikealla valuutalla saa sitten mitä vain. Paluu entiseen siis: sekä moskovassa että Washingtonissa saa taaloilla mitä vain ja ruplilla ei mitään.

Jätän raadin pohdintaa mitä tämä tarkoittaa örkin sotimisintoon kun palkka tulee ruplissa mutta niillä ei teekkään mitään. Tätä muutostahan ne temu-sotilaatkin indikoi, niille maksetaan öljyllä, tai siis rakettimies saa öljyä ja käskyttää armeijaansa marssimaan lihamyllyyn.

Noo, kattellaan miten pitkäälle se lilliputinismin aate kantaa rintamalla.

teknohippi

Ylipäällikkö

Pitipä tarkistaa mitä Forex sanoo rupulasta. Näemmä tilanne on tämä:

Yleensä tilanne on oikeasti paha kun edes Forex ei vaihda pieniäkään summia. Tähän asti Forex on aina luvannut kuitenkin jotain kun käynyt katsomassa mitäs ruplista saisi. Kurssi nyt on ollut jotain 20% pakkasella mutta nyt on totaali haltti.

Yleensä tilanne on oikeasti paha kun edes Forex ei vaihda pieniäkään summia. Tähän asti Forex on aina luvannut kuitenkin jotain kun käynyt katsomassa mitäs ruplista saisi. Kurssi nyt on ollut jotain 20% pakkasella mutta nyt on totaali haltti.

taantumu

Ylipäällikkö

Venäjän talouskehitysministeri Resetnikovin mukaan kaikki on hyvin. Ruplan kurssin heikkeneminen johtuu ulkoisista asioista ja valuuttamarkkinoihin vaikuttavista mielialoista eikä talouden romahtamisesta.

https://www.kommersant.ru/doc/7329348?from=top_main_4Reshetnikov said there are no fundamental factors for the weakening of the ruble

Economy Minister Maxim Reshetnikov said that he does not see any fundamental factors in the weakening of the ruble. The minister named the strengthening of the dollar against world currencies and concerns of participants in foreign economic activity about further interaction with counterparties against the backdrop of tightening sanctions against Russia as the main reasons for the weakening of the national currency.

“The current weakening of the exchange rate is not associated with fundamental factors, we see that the trade balance is strong... In addition, as often happens in such situations, there is currently an excessive emotional component on the currency market. Experience shows that after a period of increased volatility, the exchange rate always stabilizes,” Mr. Reshetnikov said on the sidelines of the Russian-Kazakh summit in Kazakhstan.

He noted that now the Russian economy is less dependent on settlements in the currencies of unfriendly countries. According to the data provided by the minister, the share of the Russian ruble and currencies of friendly countries in the second half of 2024 reached 82% in exports and 78% in imports.

Today, November 27, the Bank of Russia announced that from tomorrow until the end of the year it will not buy currency on the domestic market. The decision was made to reduce volatility. Today, the dollar has already risen in price by several rubles on the international market. Around 16:00 Moscow time, the dollar exchange rate on the international forex market exceeded 114 rubles, reaching 114.5 rubles (+8.54%).

-TripleX-

Respected Leader

Yksi arvio vaikutuksista sekä mitä Venäjä voi yrittää tehdä ruplan heikkenemisen estämiseksi.

cepa.org

cepa.org

Kun kulutussotaa käyvän maan teräksen kulutus ja tuotanto laskevat hälyttävän nopeasti niin se kertoo kyllä kaiken tarpeellisen, homma kusee aivan huolella perusasioita myöten.

Kremlin Options Narrow as Ruble Slumps

The Kremlin and Putin regime still has options to halt its currency slide, but they will cause consequences elsewhere in an troubled economy.

Kun kulutussotaa käyvän maan teräksen kulutus ja tuotanto laskevat hälyttävän nopeasti niin se kertoo kyllä kaiken tarpeellisen, homma kusee aivan huolella perusasioita myöten.

Viimeksi muokattu:

taantumu

Ylipäällikkö

Medvedevin mukaan lansi kärsii pakotteista enemmän kuin Venäjä ja pakotteet ovat olleet positiivinen asia Venäjälle sillä valmistusta on pitänyt siirtää kotimaahan.

https://tass.ru/ekonomika/22515215Medvedev is confident that the West suffers more from its sanctions than Russia

DUBAI, November 27. /TASS/. Western sanctions bring their authors more problems than they do to Russia. This opinion was expressed by Deputy Chairman of the Russian Security Council Dmitry Medvedev in an interview with the Al Arabiya TV channel.

"Of course, sanctions are bad, we have always said so," he noted in response to a question about whether Russia expects sanctions to be lifted after US President-elect Donald Trump takes office.

Medvedev recalled that the lifting of sanctions against Moscow was one of the topics of the Istanbul talks with Kiev. "But sanctions are a double-edged sword. They hit not only Russia, but also the entire Western world, especially Europe. And they are hit harder," the Deputy Chairman of the Russian Security Council said.

"The sanctions have forced us to work on reviving entire sectors of the Russian economy. And in this sense, the sanctions, strange as it may seem, are playing a positive role," Medvedev said in an interview with the Al Arabiya TV channel.

He cited Uralvagonzavod, where the interview took place, as an example. "This enterprise is currently busy, it is working and creating new products. Products both in the field of civilian production and in the field of military production, that is, military cooperation and development of the military industry," the politician said.

Laskinko, että 9 tavarajunaa ajettu Vainikkalasta Kotkaan ma-ke. Ei oo pitkään aikaan tullut noin paljoa kolmessa päivässä.

Lieneekö syy, että pelätään että Venäjän rautatiet sortuu ja varastoihin tuodaan tavaraa suurin määrin. (Ja toki Suomessa vuodenvaihteen jälkeen rautatierahdit kallistuu ja koska ne Venäjän vastaavat nousee)

Lieneekö syy, että pelätään että Venäjän rautatiet sortuu ja varastoihin tuodaan tavaraa suurin määrin. (Ja toki Suomessa vuodenvaihteen jälkeen rautatierahdit kallistuu ja koska ne Venäjän vastaavat nousee)

-TripleX-

Respected Leader

Venäjällä nousee rahtihinnat 13.8 % joulukuun 1. Samalla lähtee hiilen kuljetuksesta kaikki alennukset pois.Laskinko, että 9 tavarajunaa ajettu Vainikkalasta Kotkaan ma-ke. Ei oo pitkään aikaan tullut noin paljoa kolmessa päivässä.

Lieneekö syy, että pelätään että Venäjän rautatiet sortuu ja varastoihin tuodaan tavaraa suurin määrin. (Ja toki Suomessa vuodenvaihteen jälkeen rautatierahdit kallistuu ja koska ne Venäjän vastaavat nousee)

Voihan tuossa alkuviikon määrässä olla valmistautumista pitkiin pyhiin vuoden vaihteessa, ensin Suomessa ja myöhemmin ryssillä.

Antares

Respected Leader

Tämäkin hyvä pitää mielessä yhtenä vaihtoehtona:

If sanctions on Gazprombank are hurting the ruble by holding up payments for energy, this effect will probably be reversed in the coming weeks once new payment mechanisms are found.

Russia is not exporting oil+gas for free and the fundamentals for the ruble didn't change today...

If sanctions on Gazprombank are hurting the ruble by holding up payments for energy, this effect will probably be reversed in the coming weeks once new payment mechanisms are found.

Russia is not exporting oil+gas for free and the fundamentals for the ruble didn't change today...

Yksi väistämätön seuraus ruplan arvon romahduksesta on, että viimeisetkin Venäjällä työskentelevät ulkomaalaiset nostavat kytkintä mikä tulee edelleen pahentamaan työvoimapulaa sekä nostamaan palkkoja, mikä sitten taas nostaa ilflaatiota. Kierre on aikalailla valmis, tervemenoa.

Lievästi ilmaistuna aika Kummelimainen otos

Voisiko joku photoshopata tuolle pomolle vielä nimenomaan keskisormen pystyyn

Voisiko joku photoshopata tuolle pomolle vielä nimenomaan keskisormen pystyyn

Näkisin tämän niin kovin mielelläni vuoden tai jopa vuosikymmen kansikuvana sille miten tuon paskatunkion tarina päättyi

edit: palkkapäivä ja valuutan sijaan ruokakuponkeja enää jaossa

Viimeksi muokattu: