Cup and Handle Pattern: How to Trade and Target with an Example

A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Learn how it works with an example, how to identify a target.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Turhaa vouhkaamista. USD on jatkossakin maailmankaupan tärkein valuutta.

Turhaa vouhkaamista. USD on jatkossakin maailmankaupan tärkein valuutta.

Nykyinen. Höpöhöpö. Ota viestini talteen ja tule katsomaan asiaa jonkun ajan kuluttua. Tulet näkemään, että Tetra oli tämänkin asian suhteen oikeassa. Ei ole merkkejä siitä, että joku muu valuutta olisi korvaamassa dollarin.Nykyinen vai kultakantaan tai kryptoon sidottu?

Minäkin toivon että olisi mutta nykyinen on kuollut.

Nykyinen. Höpöhöpö. Ota viestini talteen ja tule katsomaan asiaa jonkun ajan kuluttua. Tulet näkemään, että Tetra oli tämänkin asian suhteen oikeassa. Ei ole merkkejä siitä, että joku muu valuutta olisi korvaamassa dollarin.

And as a side note, dollarin heikkous on tietenkin haitallinen asia vientivetoisille euromaille.

Gifit ovat aiheessa muodissa, joten laitetaas tälläinen.

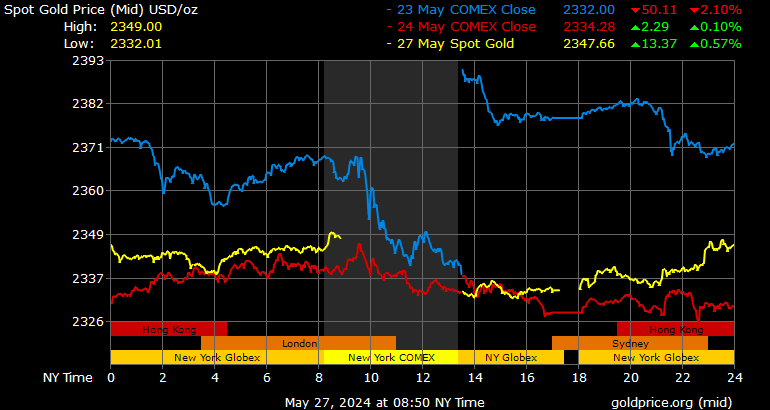

Minulla ei ole positiota näissä kommoditeeteissä.Pakko tosiaan ottaa talteen, mikä on muuten oma positiosi kullassa ja hopeassa?

Minulla ei ole positiota näissä kommoditeeteissä.

Koska en ole gold digger.Saako kysyä että miksi hitossa ei?

Koska en ole gold digger.

Pöpipäät ovat ennustaneet dollarin korvaajaa vuosikymmenen. Ei ole toteutunut eikä toteudukaan.Turhaa vouhkaamista. USD on jatkossakin maailmankaupan tärkein valuutta.