https://intellinews.com/long-read-russia-s-sanctions-soft-underbelly-precision-machine-tools-213024/

LONG READ: Russia’s sanctions soft underbelly: precision machine tools

By Ben Aris in Berlin June 13, 2021

The West has been struggling to change the Kremlin’s behaviour and hold it to account for the annexation of the Crimea in 2014 and a host of other misdemeanours with a sanctions regime that has proved to be almost entirely ineffective. Oligarchs have been targeted; visa bans and asset freezes doled out; Russia’s debt made out of bounds for international investors. Yet thanks to President Vladimir Putin’s

fiscal fortress, all these measures have slid off the Kremlin’s back like water off a duck's back.

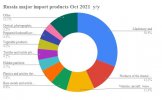

However, there is one place that Russia is truly vulnerable. It imports almost all of its precision machine tools and the majority of them come from Western Europe and the US, as its own once legendary machine tool sector was destroyed in 1991 and never rebuilt.

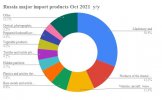

Machinery and tools remains by far Russia’s largest import category, but precision tools are more important than just the money they cost. High-quality machine tools lie at the heart of Russia’s efforts to modernise itself. It can’t build an autonomous competitive economy without precise machine tools and they are also the wellspring of innovation. Without access to quality machine tools Russia would still earn money from oil, gas and metal exports, but all the Kremlin’s ambitions to develop a modern highly competitive economy would be badly hobbled and nigh on impossible.

Collapse of the machine tool industry

At the start of the coronavirus (COVID-19) pandemic Russia covered itself in glory. The development of the Sputnik V vaccine, which appears to be one of the safest and most effective in the world, was developed with amazing speed. The rollout of a mass inoculation programme began in December 2020 when most other vaccine candidates were still in trials.

Russia is good at the science. It put the first man into space under a totalitarian regime. Where it has always fallen down is on high-quality production. The vaccine's development was fast, but the construction of the factories to make Sputnik V in large amounts has been painfully slow. By the end of May

Russia had met only 8% of its export orders despite the vaccine having been approved in over 60 countries and orders for hundreds of millions of doses worth billions of dollars.

Since then the production bottlenecks are slowly being circumnavigated. As of the middle of June

Russian factories have been cranking out 30mn doses a month and are beginning to be able to meet the demand. But it has taken longer to build the factories than it has taken to develop the drug in the first place.

There are two problems that have held back a faster rollout of mass production: the lack of qualified staff and the lack of the basic machine building technology to manufacture the intricate machines needed to produce a complicated drug like Sputnik V.

Russia is famously bad at making anything other than space rockets and fighter jets. The Soviet Union had exploding tellies and opaque sunglasses. Quality consumer goods didn't exist.

The irony is the Russia revolution was built on the back of an industrial revolution powered by a huge machine tool industry under Stalin that embraced mechanisation and transformed the Russian empire from a bucolic backwater to an industrial superpower by the outbreak of the Second World War.

Machine building and the revolution were synonymous. “Communism is Soviet power plus the electrification of the whole country!” went the famous slogan. Soviet machine building exploded in the 1980s, but the USSR quickly fell behind after the advent of more precise “numerical” machine engineering – pioneered by the Japanese and Germans. Even the US struggled to keep up with this first innovation.

Since then machine tool production has taken several more technological leaps upwards, thanks to the advent of the computer and now the internet. Today it's all about “mechatronics” – a marriage between machines, electronics and the internet. As most of these huge changes happened in the 1990s when Russia was flat on its economic back, it simply missed out on all of it.

“After decades of neglect and weak demand for its products, the Russian machine tool industry is in a deep crisis,” says Tomas Malmlöf of the Swedish Defence Research Agency (FOI) in a recent

report. “The great demand for machine tools that nevertheless exists in the Russian industry, not least within the defence industry, is now mostly covered by imports, and Russia has become the fourth-largest importer of machine tools in the world.”

That’s a big problem. While tool-making contributes only a tiny share of GDP – in Japan, a world leader, machine tool making accounts for 1.9% of GDP – the machine tool industry provides the principal industrial equipment base for all other manufacturing industries.

Everything is affected by the quality of the tools used to make things: heavy industry, the machinery industry, the car industry, power engineering business, shipbuilding, the aircraft industry and the entire defence sector. Being entirely reliant on imported tools is not a good place to be for a country like Russia that aspires to become autonomous in industry and defence.

Russian machine tool industry was already falling behind in the 1980s, but following the collapse of the Soviet Union in 1991, it simply disappeared. In 1990, production of metal-cutting machine tools amounted to 74,000 pieces. In the next five years, output fell to 18,000 components, according to official statistics. In 2009, this figure had shrunk to 2,000. Since then, the situation has somewhat stabilised, and in 2016 production of metal-cutting machine tools reached almost 4,400 components – a 16-fold decline. But just because Russia wasn't making tools any more didn't mean it wasn't using tools.

“The crisis in the Russian machine tool

industry was not a crisis for the Russian machine tool

market, as such. What happened was that the domestic machine-building industries increasingly turned to foreign machine tool providers,” says Malmlöf.

Today Russia

Today Russia

During the noughties Russia’s economy boomed, doubling in size, funded by a torrent of inbound petro-dollars. The government invested heavily in rebuilding infrastructure but things like the new high-speed rail link between Moscow and St Petersburg was built by Siemens, as was nearly every new gas turbine in every new power station in the country.

In a more recent high-tech example, the head of Roscosmos Dmitry Rogozin complained that while Russia has plenty of rockets, and may build its own version of the International Space Station if the rows with the US continue, it can’t launch any new satellites, as they are missing a high-tech chip that is only produced in the West. Although there are no official sanctions on the chip, Western manufacturers are refusing to sell it to Russia. Roscosmos has tried sourcing analogues from markets like India and Brazil, but the quality is simply not good enough.

Even in the car industry Russia is now home to five big car companies with extensive manufacturing plants, but despite energetic programmes to force foreign carmakers to increase the share of locally made parts to at least 60%, the car plants in Russia are still heavily dependent on imports. Part of the problem here is the foreign manufacturers are reluctant to share their technology for fear of creating a rival, but local part-makers are not good enough to offer a viable alternative.

The dearth of the domestic production of high-quality machine tools is both a strategic and economic threat to the country. And yet little has been done to address the problem.

Mechatronics

Russia now has a lot of catching up to do, but developing the tech will be very hard.

One example is the

“five axis grinders

”: special grinders that can cut and shape metal into complicated shapes. These machines are core to dozens of industries, including weapons manufacture, and the dual-use implications mean the manufacturers routinely build in special controls that disable the machine if it is moved from its original location.

The recent integration of digital control technology and computers into machine tools hit the industry in three waves of technology shocks that lasted about ten years each and all of them simply washed over Russia.

“The introduction of numerical controls (NC) for machine tools in the 1950s and 1960s enabled some degree of automation of production processes. The second wave, in the 1970s and 1980s, entailed the use of microcomputers for numerical control (CNC). CNC machines offered new features, were more flexible and led to a substantial drop in price,” says Malmlöf.

“The present, third wave is comprised of the PC-based CNC machine and began around 1990…. The introduction of digital controls had a disruptive market impact. Numerical control enabled fundamental changes in product architecture as several processes [that] converged into multi-purpose machines. Flexibility in design, development and production increased, which resulted in shorter product cycles, faster product development and a push for speedier order delivery… The core competence of manufacturing therefore shifted from accurate mechanics to electrical engineering and programming.”

What used to be tools are now mechatronics, a whole new class of tools – the combination of mechanical engineering and electronics that is wrapped up in the “Internet of Things” to come.

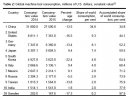

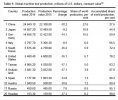

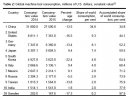

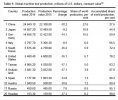

In terms of output by value and consumption then Japan and Germany are still the giants in the business. China is also high in the list, but its tools tend to be at the low-end of the sophistication spectrum, although the government has been investing massively in R&D in an effort to catch up. America is a huge consumer and a big producer, but even the US imports about 60% of its tool needs, while China imports about a third of its tools. By contrast, Russia produces a tiny amount of tools and imports almost 100% of its requirements.

Machine Tools trade & sanctions

Machine Tools trade & sanctions

Russia’s total dependence on imports makes specialised machine tools a candidate for sanctions that would be highly effective, as they would bring Russian economic development to a standstill, or at least severely slow the pace of growth. A blanket ban on any exports of any precision machine tools to Russia would have devastating effects.

The trouble is sanctions on tool exports to Russia would also have devastating effects on the European and US industries. As the machine tool-making business is not particularly capital intensive the business is dominated by specialist small and medium-sized enterprises (SMEs). There are a few large corporates with deep pockets that can ride out swings in demand, but most are not. Moreover, as machine tools are in effect investment capital, the industry is very sensitive to the vagrancies of the economic cycle.

“An important feature of the machine tool industry is its highly volatile cyclicity. This is because machine tools are not just another primary input in the production process, but are used to produce other investment goods,” says Malmlöf. “It therefore suffers a double effect of the accelerator principle: when demand in final products decreases, demand for investment goods falls even more, and demand for machine tools falls the most.”

Given that a country like Germany has so many SMEs in this sector, cutting them off from the huge lucrative Russian market would be politically very difficult indeed.

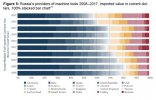

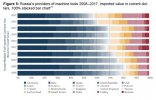

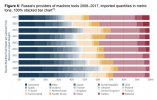

For its part Russia has already been trying to actively break its dependence on EU and US machine tools. Now it now imports from over 70 countries, but all that has happened is Russia increasingly buys the low tech tools from developing markets while the share of the most sophisticated and most expensive tools from countries like Germany, Italy, Japan and the US has actually increased.

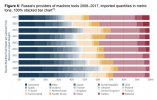

“From the late 2000s, Russia has diversified its imports of machine tools, either voluntarily or as a necessity, due to its deteriorating relationships with the [liberal Western countries],” says Malmlöf. “Yet in 2017, this group still provided 57% of Russian machine tool imports in the sample based on import value… The quantity of Russian import from potentially unfriendly countries has diminished significantly during the ten years in the sample, at the same time as friendly countries have increased their market share… Russia has substituted a noticeable share of its import of high-end machine tools from the most advanced machine tool-producing countries for less expensive Chinese, Turkish and Belarusian machine tools.”

Point of no return?

Point of no return?

What’s left of Russia’s machine tool business is mostly focused on the defence sector, as some military production is considered so sensitive that it is inconceivable that any foreign-tech would be allowed on the premises.

There have been a couple of attempts to revive the machine tool industry but it simply didn't get much attention during the first two decades following the fall of the Soviet Union. After comprehensive military modernisation programme was launched in 2011 that has changed, and a more serious attempt to revive the business is underway.

In the late 2010s, Russia’s machine tool industry accounted for 0.02% of GDP. This is a low figure compared to some of the leading producing countries: China (0.2%), Japan (0.33%) and Germany (0.37%).

According to the Russian Ministry of Industry and Trade, there were 80 domestic machine tool firms in total, and 29 tool companies, in 2017. The output of its top six companies accounted for 54% of Russia’s domestic production.

In June 2017, the Ministry of Industry and Trade, under Minister Denis Manturov, proposed a new comprehensive development strategy for the machine tool and tool industries 2018-2030 that was based on a much more thorough study of the international business.

“The primary goal of the proposed strategy is to increase the competitiveness of the Russian machine tool industry and to restore their position on the home market,” says Malmlöf. “By 2030, the share of Russian machine tools on the domestic market should increase to 50% and the yearly growth rate should be 15%, on average, according to the proposed target indicators.”

According to the Ministry proposal, the strategy should be implemented in two stages. During the first stage, up to 2021, all state policies for the machine tool industry ought to focus on strengthening the position of a few strong market actors among current companies and turn them into national champions.

The state should also stimulate the emergence of new market participants in those market niches where the current companies are not active.

The purpose of state policy during this stage is thus to bring about intensive economic growth within the industry, to empower existing companies to fully exploit their potential, to develop new technologies and to seize broad market niches.

During the second stage, 2022-2030, the industry should be capable of shifting towards extensive growth. Production volumes would increase as a result of the active state support during the previous stage.

The Ministry expects new actors to enter those market segments for final products, sub-components and instruments that the national champions have not already seized. Among them will be technology owners, modernised defence firms and companies from the nuclear industry.

The jury remains out on whether this programme will be a success. The Chinese have been pouring money into its R&D sector and actively hiring “turtles” – Chinese workers that cut their teeth in foreign R&D departments, but have been lured home to develop Chinese tech. The Russian government has earmarked RUB63.5bn ($910mn) for the programme, with most of the spending frontloaded to be spent in the next two years. Added to that, Russia has never been a slouch when it comes to science.

threadreaderapp.com

threadreaderapp.com

Partial martial law. What will change after Putin introduces special regimes in the European regions of Russia and the occupied regions of Ukraine

Partial martial law. What will change after Putin introduces special regimes in the European regions of Russia and the occupied regions of Ukraine ️ Ukrainians living in the occupied territories may be forcibly interned (isolated). The law provides for such a rule in relation to citizens of countries with which the Russian Federation has a conflict.

️ Ukrainians living in the occupied territories may be forcibly interned (isolated). The law provides for such a rule in relation to citizens of countries with which the Russian Federation has a conflict. poop

poop