MILITARY BALANCE BLOG

14th April 2025

Russia doubles down on the Shahed

Russia is intensifying its focus on Shahed OWA-UAV operations by launching ever-increasing numbers, expanding production capabilities and refining tactics.

This blog post was first published on the Military Balance+ on 11 April 2025

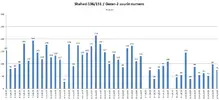

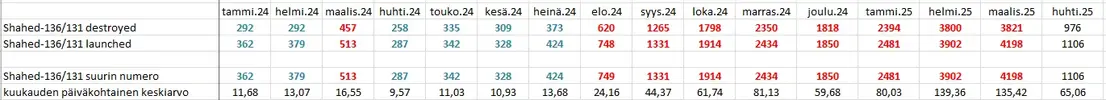

Russia’s use of one-way attack uninhabited aerial vehicles (OWA-UAVs) in Ukraine intensified during the latter months of 2024 and has shown little sign of slowing in 2025.

Ukrainian Air Force figures

show that since June 2024, there has been a month-on-month increase in OWA-UAV attacks, with 2,300 launched in November 2024 and 2,696 in January 2025. This growth has been enabled by Russia’s ability to increase local production of a version of the Iranian

Shahed 136 OWA-UAV.

In 2022, Iran began supplying

Shahed 131 and

Shahed 136 OWA-UAVs for Russian use in the war in Ukraine. Shortly thereafter, Iran initiated a large-scale technology transfer programme to facilitate the production of these systems in Russia. Domestically manufactured variants of the

Shahed 136, designated

Geran-2, remain the cornerstone of Russia’s deep-strike OWA-UAV campaign.

Shahed production facilities

Russia’s commitment to the use of long-range OWA-UAVs is not only reflected by the increasing number of systems but also by the expansion of its production capacity. Ukrainian sources have previously

stated that Russia produced more than 6,000 OWA-UAVs in 2024 and aims to increase these numbers through 2025. This claim is supported by satellite imagery showing the development of infrastructure for

Shahed production.

Alabuga production line

Despite a steady flow of

Shahed 136s from Iran, Moscow is heavily investing in its own production facilities, and the Alabuga Special Economic Zone (SEZ) has long been assessed to be a production facility for Russian-manufactured systems.

At the time of its initial operation in early 2023, the production site consisted of two warehouses with an approximate area of 80,000 square metres. Satellite imagery from April 2025 indicates that the facility has doubled in size, with at least five new buildings in the vicinity of the original site. Three of the new buildings appear to have the same anti-UAV cages identified at the original site, a precaution implemented in the wake of a

Ukrainian attack in April 2024.

Both physical and operational security measures have been enforced. Around the original two warehouses and two new buildings directly to the west, a perimeter fence has been erected. The same is in place around the two buildings to the northwest of the site, both of which are connected to the original site via covered walkways, likely built to enable the transport of components between buildings. Furthermore, upon entry to the SEZ, all vehicles are now required to have an

electronic pass.

Wider developments of the Alabuga SEZ are also underway. To the southeast of the original site, the construction of structural elements for four new buildings has begun. Further afield, yet still within the remit of the SEZ, the Deng Xiaoping Logistics Complex commenced operation recently. Situated approximately 30 km south of the main site, it is a joint Russian-Chinese facility and at least one train is expected to depart and arrive at the site every week, providing a potential entry route for any Chinese components used in OWA-UAV production in the region.

Izhevsk production line

There is evidence to suggest that Russia has established a second production line for

Shahed 136 copies in the city of Izhevsk. In late 2023,

Reuters reported that Russia was producing a new OWA-UAV that is externally almost identical to the

Shahed 136 but which uses a Chinese copy of the

Limbach 550 engine rather than the Iranian original. According to the report, this production line is operated by IEMZ Kupol, a subsidiary of Almaz-Antey that was previously involved in developing target drones.

Shahed assembly at an undisclosed facility

matches the

unique design features of the OWA-UAV described by Reuters. The structure also corresponds with the

layout of a newly acquired and refurbished Kupol facility in Izhevsk. Vehicle presence at the facility, coupled with Ukrainian Military Intelligence

reports linking new

Shahed UAV serial prefixes to Izhevsk, suggests that the IEMZ Kupol plant is not only operational but may already be engaged in high-volume production.

Improved tactics and use of decoys

More recently, the

Geran has been complemented by the

Gerbera and

Parodiya; these simple and affordable decoy systems are intended to overwhelm Ukrainian air defences and chart a path for

Shaheds.

Russia has sought to enhance the operational capabilities of its OWA-UAV systems through technical modifications to the

Geran. Developments include the integration of new

jamming-resistant controlled reception pattern antennae, the introduction of

different warheads, and the use of datalinks that

can use Ukraine’s mobile telephone network. According to

Ukrainian military intelligence, Russia is also currently establishing a production line for the jet-powered

Shahed 238. This claim, however, has not been independently verified.

The advances made through updated tactics and technical modifications are somewhat diminished by a decline in system reliability. In the face of growing financial pressures, Russia has attempted to cut costs in the manufacture of the

Shahed, and high-quality Western components are being replaced by cheaper, failure-prone Chinese equivalents.

Increasing numbers, increasing challenges

Ukraine has adopted several innovative measures to counter the threat posed by

Shaheds. Among these are

low-cost acoustic detection networks that provide early warning of incoming threats and

mobile firing teams equipped with machine guns mounted on SUVs, which have proven effective in neutralising

Shaheds in an affordable manner. Additionally, Ukraine has enhanced its electronic warfare capabilities, employing jamming and spoofing techniques that have reportedly caused

Shaheds to deviate from their intended targets and

return to Russian and Belarusian airspace. More recently, Ukraine has begun

developing and fielding specialised interceptor UAVs to neutralise

Shaheds after the experimental use of first-person view UAVs in this role proved unsatisfactory. Combined with quality and reliability issues in mass-produced

Shaheds, these measures have contributed to a relatively low proportion of platforms successfully reaching their intended targets.

Nonetheless, Ukraine continues to employ high-end interceptors to counter

Shahed attacks, adding strain to its already stretched air defence systems. This pressure is likely to intensify as Russia expands its production capacity, improves the systems used and refines its operational tactics. With Moscow doubling down on the production and use of long-range OWA-UAVs, Ukraine and Western countries that could also be threatened by these systems in the future will need to develop new capabilities and strategies to address this evolving challenge.

-

AUTHORS

Vihollinen heitti taisteluun suuren määrän kalustoa.

Vihollinen heitti taisteluun suuren määrän kalustoa. Taistelun tulokset ovat vaikuttavia:

Taistelun tulokset ovat vaikuttavia:

”Punaisen Kalinan” taistelijat murskasivat vihollisen Pokrovsken suunnalla!

”Punaisen Kalinan” taistelijat murskasivat vihollisen Pokrovsken suunnalla!

Alustavasti vahvistetut tappiot:

Alustavasti vahvistetut tappiot: Yli 240 miehittäjää eliminoitu

Yli 240 miehittäjää eliminoitu