Ketjun aiheeseen liittyen.

Fitch Affirms Russia at 'BBB-'; Outlook Positive

https://www.fitchratings.com/site/pr/10021550

KEY RATING DRIVERS

Russia's ratings balance a strong sovereign balance sheet, robust external finances and an improved policy framework against weaker macroeconomic performance than peers, structural weaknesses (commodity dependence and governance risks) and geopolitical tensions.

The Positive Outlook reflects continued progress in strengthening the economic policy framework underpinned by a more flexible exchange rate, a strong commitment to inflation- targeting and a prudent fiscal strategy. This policy mix is contributing to improved macroeconomic stability and, together with robust external and fiscal balance sheets, increases the economy's resilience to shocks.

The federal budget deficit is estimated to have narrowed to 1.5% of GDP in 2017, less than half the 2016 outturn and well below the 'BBB' median. The non-oil deficit shrank to 7.9% of GDP in 2017 from 9.1% in 2016. Fitch forecasts that Russia will record a fiscal deficit of 0.6% in 2018 (outperforming the budgeted 1.3% deficit), reflecting higher-than-budgeted oil prices, continued non-oil and gas revenue growth and expenditure restraint. The current official 2019 primary balance forecast should be achieved comfortably, with Fitch forecasting surpluses at both the primary and overall levels.

The government is expected to continue to adhere to its new fiscal rule in the face of positive revenue dynamics. Although the current fiscal break-even oil price is higher, oil revenues above the budgeted level of USD40/b in real terms will be accumulated through FX intervention to limit the impact of oil prices on the real effective exchange rate. Savings in the National Wealth Fund (NWF) declined to 4.1% of GDP in 2017 and accumulated oil and gas revenues derived from FX intervention amounted to 0.9% of GDP. As expected, the Reserve Fund was exhausted in 2017 and the NWF will be the sole conduit for future fiscal savings. FX intervention under the Ministry of Finance programme will lead to an accumulation of assets this year for the first time since 2014. NWF assets plus extra oil and gas revenues could rise to at least 6% of GDP in 2018.

Fitch estimates that the general government debt ratio (including subnational governments and guaranteed debt) declined to 15.5% of GDP in 2017, among the lowest in the 'BBB' category. Federal government debt fell to 12.5% of GDP from 13.1% in 2016. In spite of the perceived risk of sanctions targeting sovereign debt, non-resident holdings of local sovereign debt increased to USD38 billion (33% of local sovereign debt) in 2017.

Russia's external balance sheet has strengthened. International reserves rose to USD433 billion in 2017, reflecting capital inflows, higher-than-budgeted oil prices leading to a higher current account surplus and increased gold holdings. Russia's international liquidity ratio is robust and the sovereign net external creditor position has strengthened since 2014 in both GDP and current external receipts terms through private sector deleveraging and greater exchange rate flexibility. The sovereign net foreign asset position is solid at 27% of GDP compared with the 'BBB' median of 4.8%.

Lower food prices and a stronger currency saw inflation fall further than expected in 2017, to an average of 3.7%, down from 7.1% in 2016. Inflationary pressures remain subdued in early 2018 with January annualised inflation at 2.2%. The central bank will continue with its gradual policy easing that has led to a 250bp reduction in the policy rate to 7.5% since January 2017, and has signalled that it could achieve a neutral policy stance earlier than expected, possibly in 2018. Fitch expects Russia's inflation to average 2.8% in 2018 before rising to 4% in 2019.

The central bank took over three of the largest private sector banks (representing a combined 7% of total system assets at the time of the intervention) in 2H17, preventing contagion and reducing systemic risks. While there are no direct costs for the budget stemming from the intervention, it has been borne by the central bank's balance sheet. The growing share of public sector banks (66% of assets in 2017) represents a potential contingent liability for the sovereign given the track record of government support and the likelihood of continued capitalisation needs. Credit growth is likely to remain moderate as increasing retail loans, most notably mortgages, are balanced by weak corporate demand.

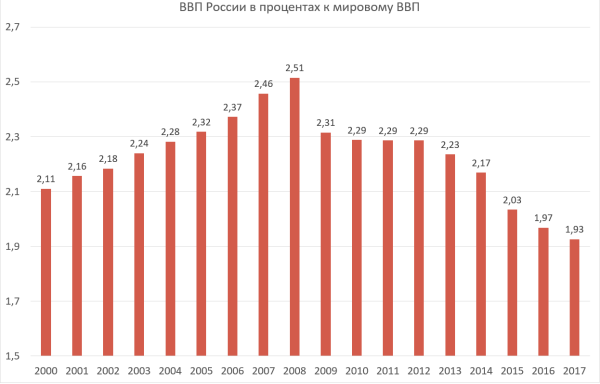

The domestic economy saw a weak growth recovery in 2017, which Rosstat initially estimates at 1.5%. We expect growth to average 2% in 2018-2019 on the back of reduced uncertainty, easing of monetary policy, and stable oil prices. This compares with a median growth rate of 3.1% for the 'BBB' category.

President Vladimir Putin is on track to win a new term in the March 2018 elections. Fitch does not expect policy changes that would undermine the improved macroeconomic framework. The main elements and timing of a broader reform agenda to achieve higher growth remain uncertain. Russia's ranking in the World Bank governance indicators is well below the peer median and the country's commodity dependence in terms of export receipts and fiscal revenues remains high relative to rated peers.

Imminent risks for the sovereign derived from tighter sanctions appear to have eased after the publication of a US Treasury report in early February that argued against targeting sovereign debt instruments due to potential negative effects for US and global financial markets. Nevertheless, Fitch notes that US domestic politics, in addition to geopolitical risks derived from the conflicts in Ukraine and Syria, currently remain a source of sanctions risk. Continued progress in consolidating improvements in Russia's consistent and credible policy framework and further rebuilding external and fiscal buffers could mitigate risks related to financing flexibility and financial stability in the event that additional sanctions are imposed.

Muutkin luokittajat antaa arvionsa ensi viikolla.

.

.

(=rashirit' prostranstvo svobody). Mitä debiili putini täällä tarkoittaakin kun kuulemma "saavutus on jo fantastinen". Tälle yleisö aplodeerasi raivoisasti:

(=rashirit' prostranstvo svobody). Mitä debiili putini täällä tarkoittaakin kun kuulemma "saavutus on jo fantastinen". Tälle yleisö aplodeerasi raivoisasti: